- Build wealth with great financial health.

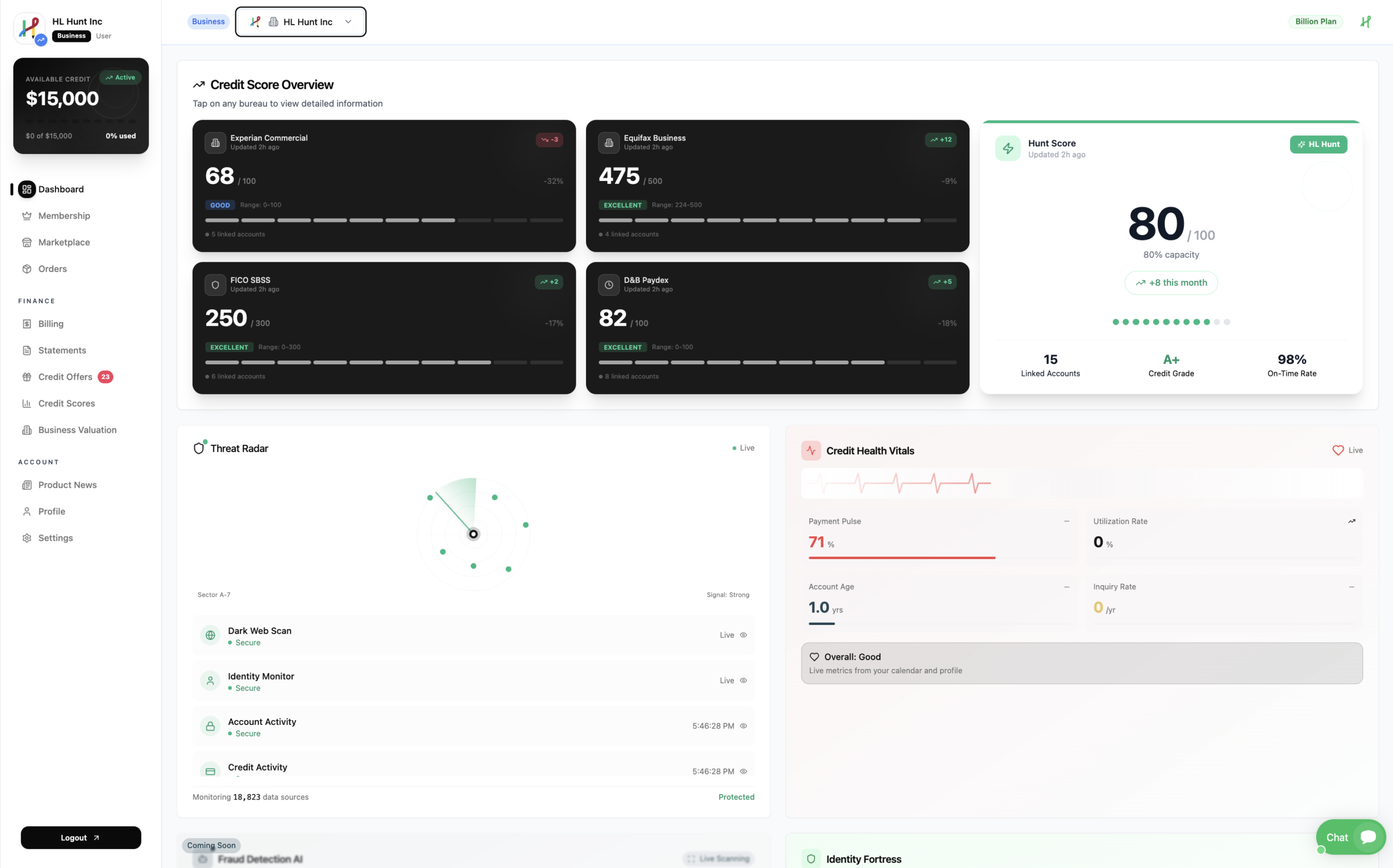

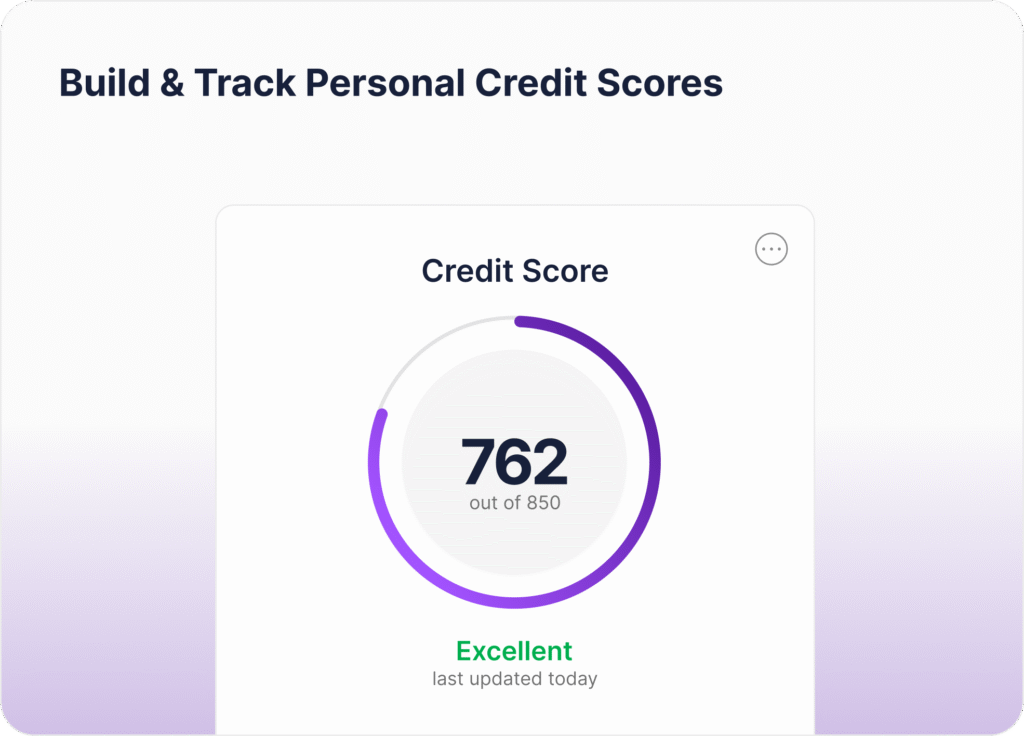

Build & Monitor Business & Personal Credit with HL Hunt.

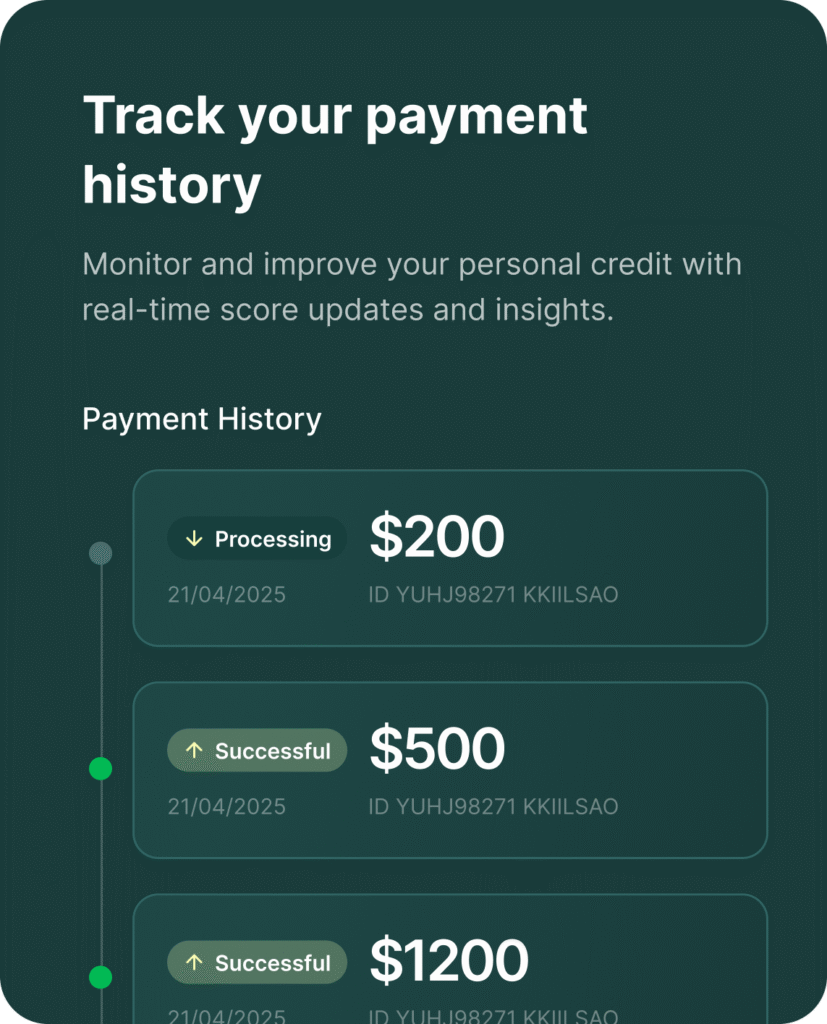

With HL Hunt’s Credit Builder, you can become a Business and Personal Member to receive a dedicated HL Hunt Credit Line. Monitor your personal and business credit scores in one place.

How HL Hunt Credit Builder Works

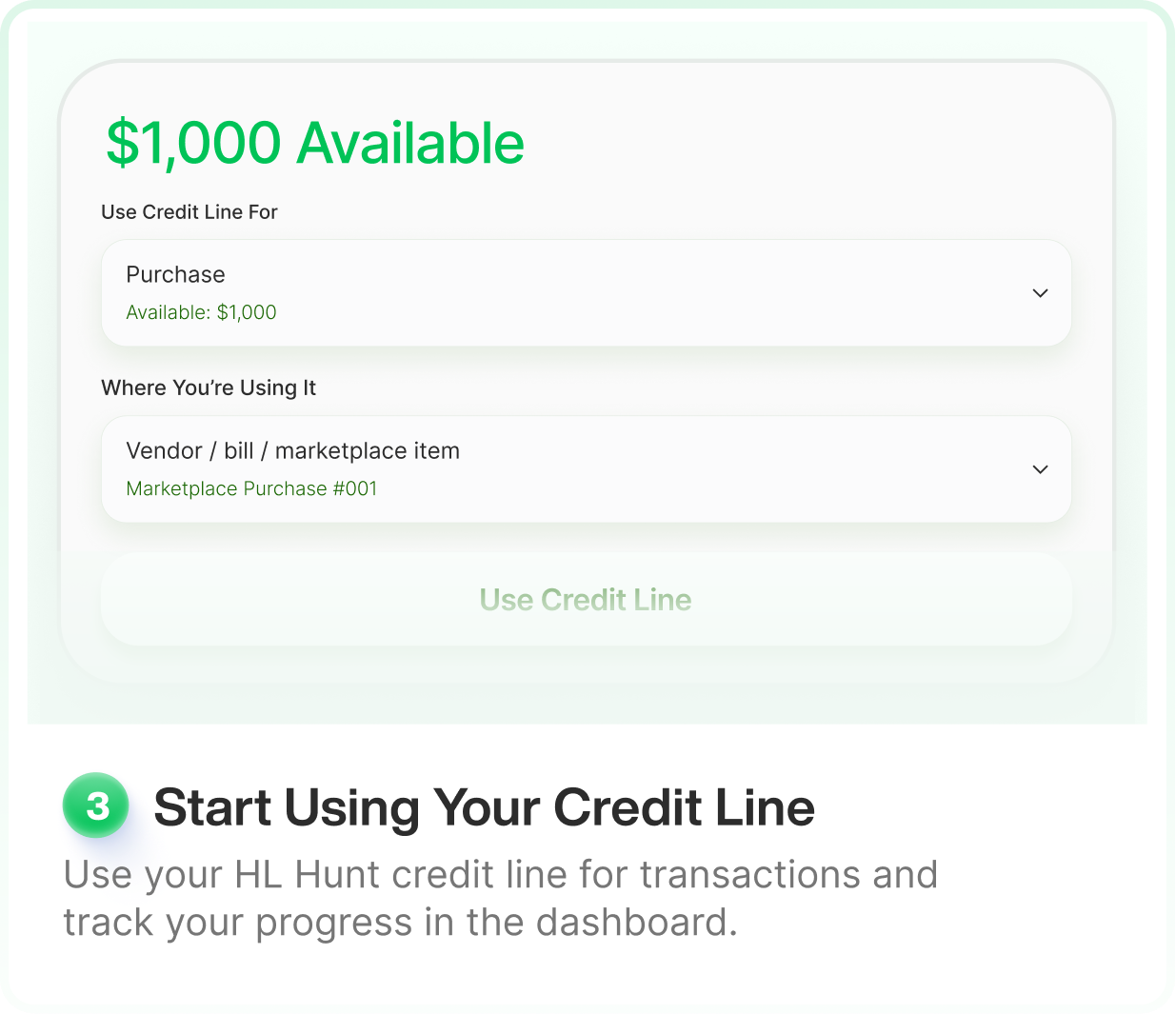

Build your personal and business credit with our exclusive tradeline system that integrates seamlessly with the HL Hunt marketplace

Your Path to Financial Freedom

HL Hunt Credit Builder is a revolutionary system that provides you with your own tradeline – a powerful financial tool that reports to all three major credit bureaus while giving you access to our exclusive marketplace.

- Build credit history with every transaction

- Access exclusive HL Hunt marketplace

- Separate personal and business credit lines

- 0% APR forever - no interest charges ever!

$25,000

Personal

Up to $10,000

Business

Up to $15,000

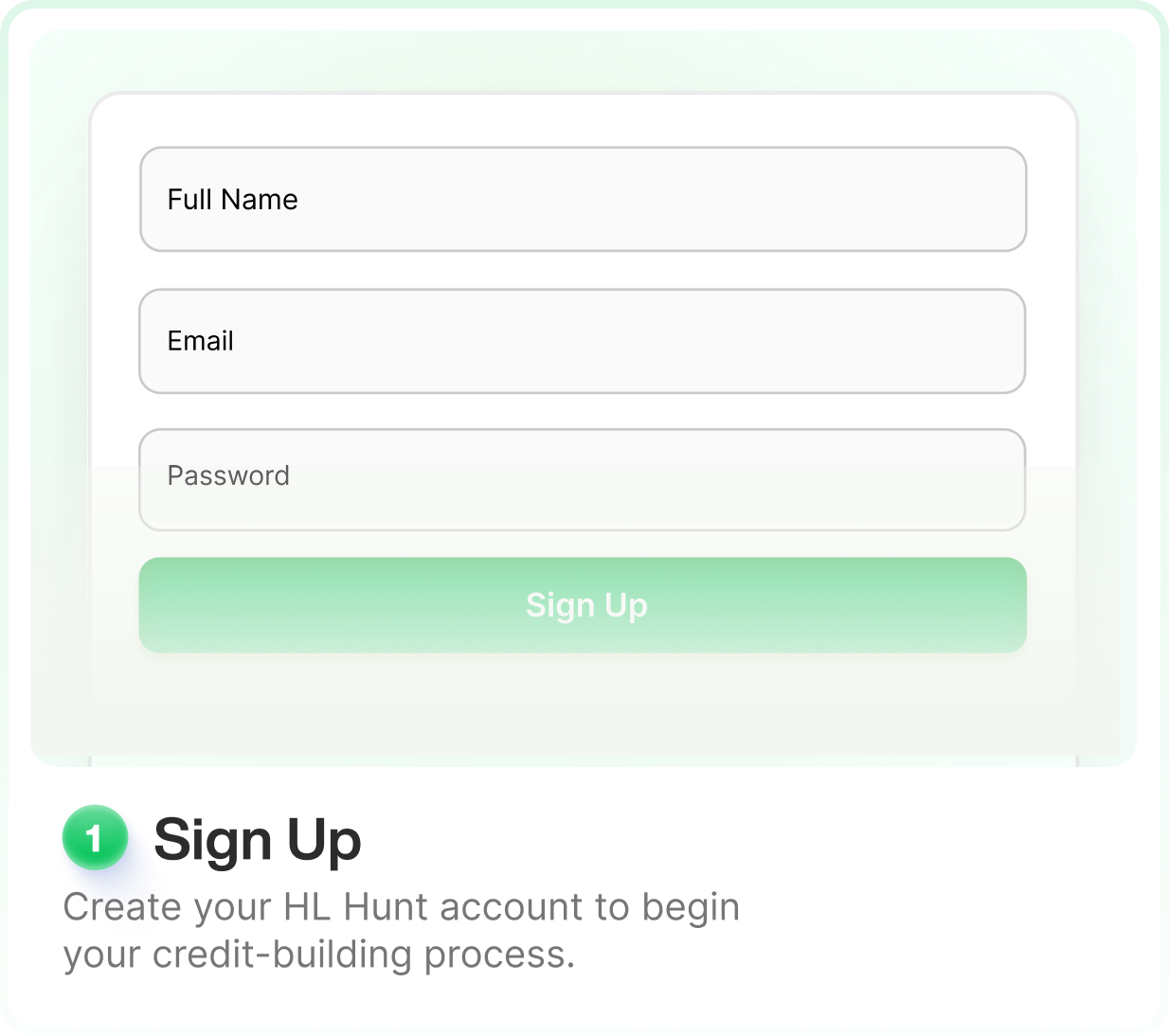

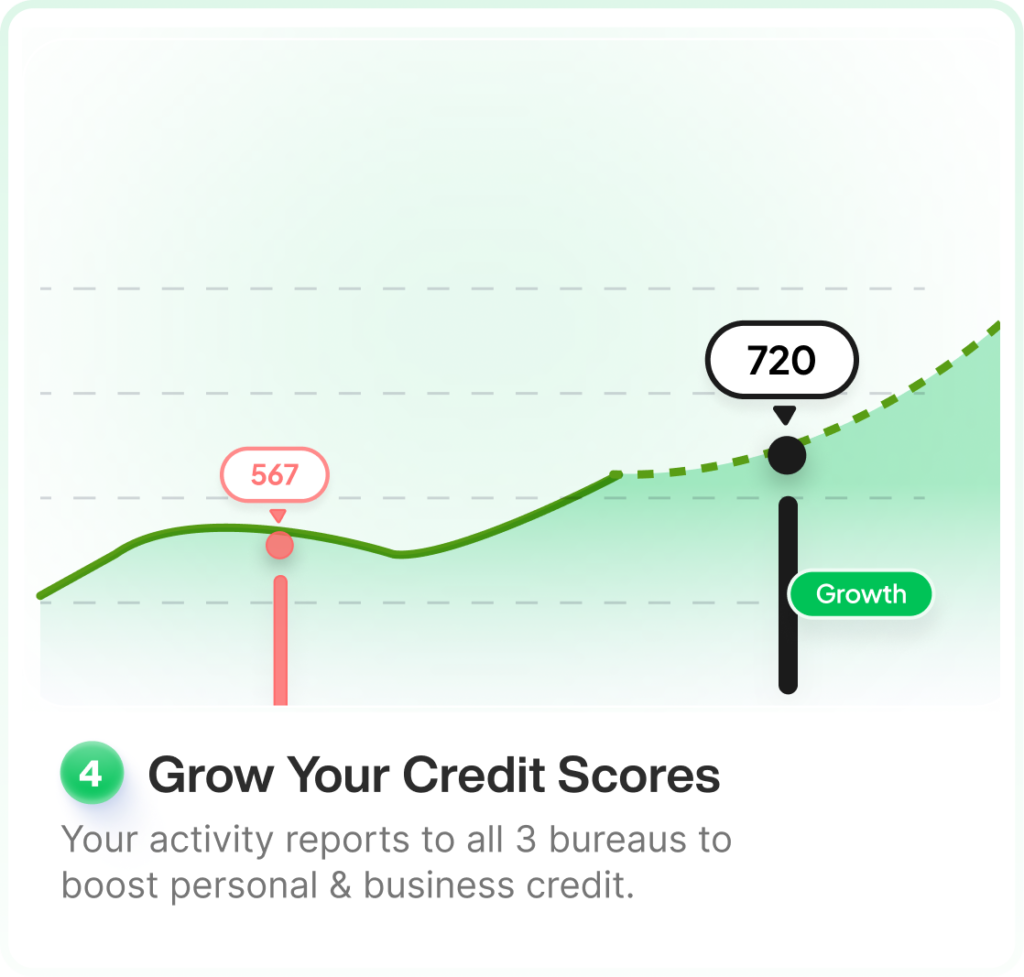

A Simple 4-Step Process

Follow these simple steps to unlock your HL Hunt credit and grow your scores

- PERSONAL

Credit Builder

What You Get:

- Personal tradeline up to $10,000

- Reports to Experian, TransUnion, Equifax

- 0% APR forever - no interest charges!

- Access to personal marketplace items

Perfect for

- Building personal credit history

- Qualifying for mortgages and auto loans

- Personal purchases and expenses

- Improving credit utilization ratios

$

9.99

USD

monthly plan

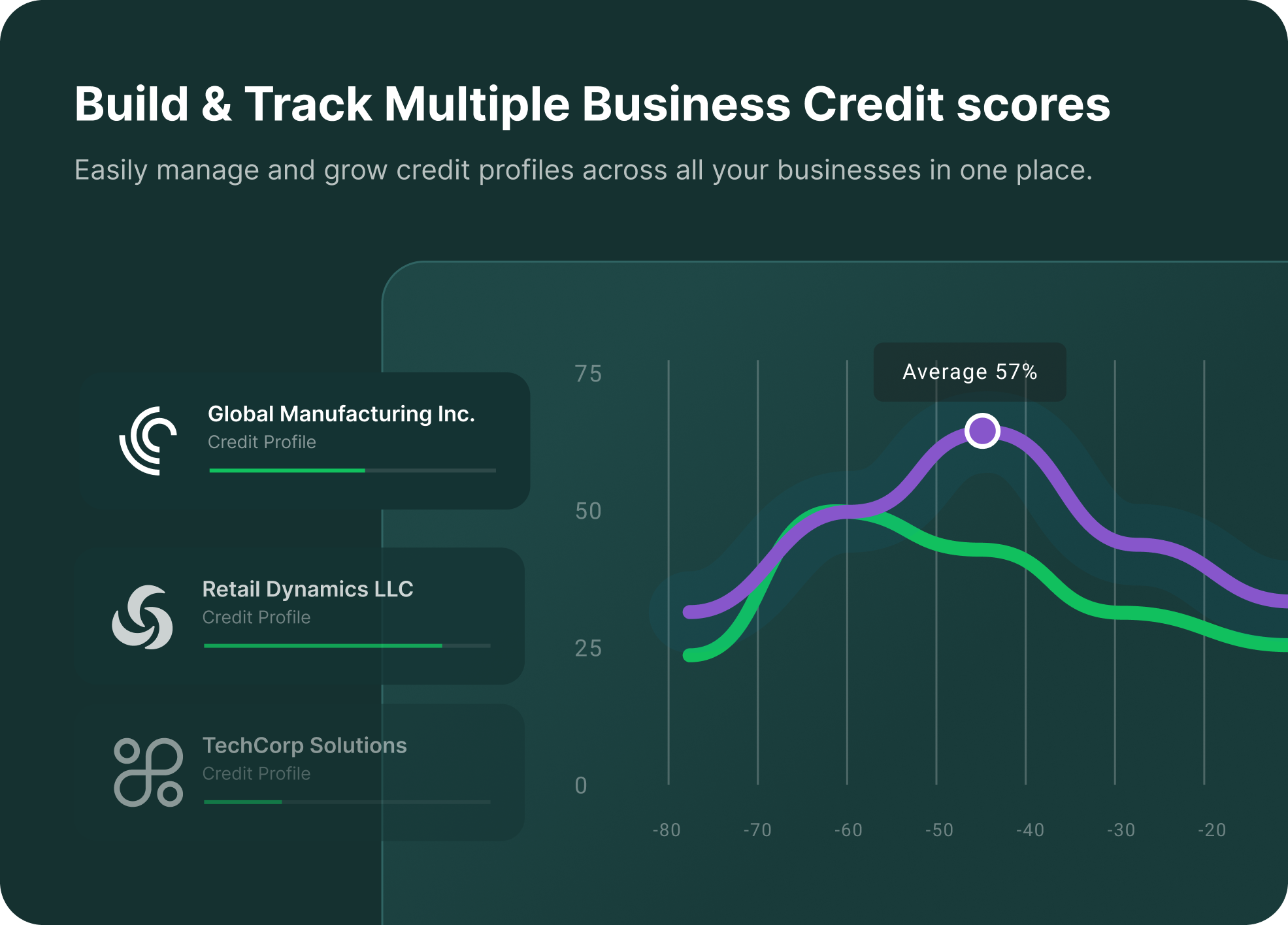

- BUSINESS

Credit Builder

What You Get:

- Business tradeline up to $15,000

- Reports to Dun & Bradstreet, Experian Business, Equifax, SBFE

- 0% APR forever - no interest charges!

- Access to business marketplace

Perfect for

- Establishing business credit profile

- Qualifying for business loans and lines of credit

- Business purchases and inventory

- Separating business and personal credit

$

9.99

USD

monthly plan

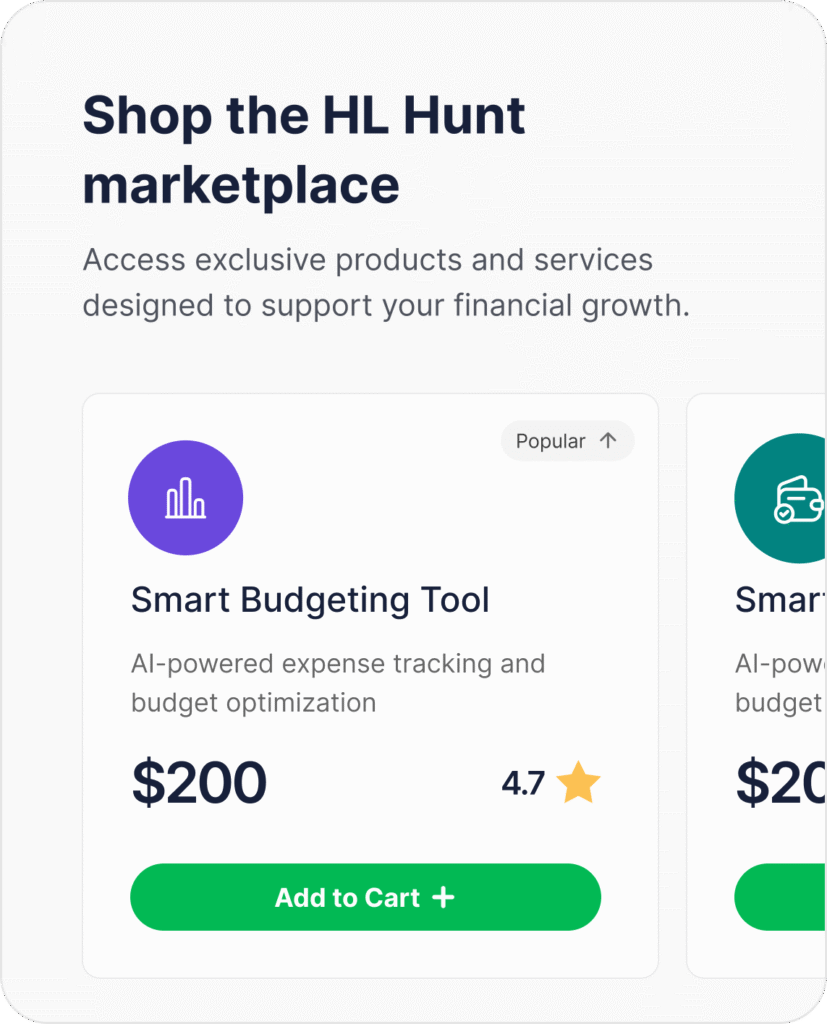

Trade Instantly

Purchase the latest smartphones, laptops, and tech gadgets using your HL Hunt tradeline while building credit.

Business Equipment

Get office furniture, machinery, and business equipment with flexible payment terms that build your business credit.

Lifestyle & More

From home goods to automotive parts, use your tradeline for everyday purchases that improve your credit score.

Exclusive Marketplace Benefits

Every purchase on the HL Hunt marketplace automatically reports to credit bureaus, helping you build credit with every transaction.

Ready to Transform Your Credit Score?

No setup fees • 0% APR • No Credit Check • Instant Approval

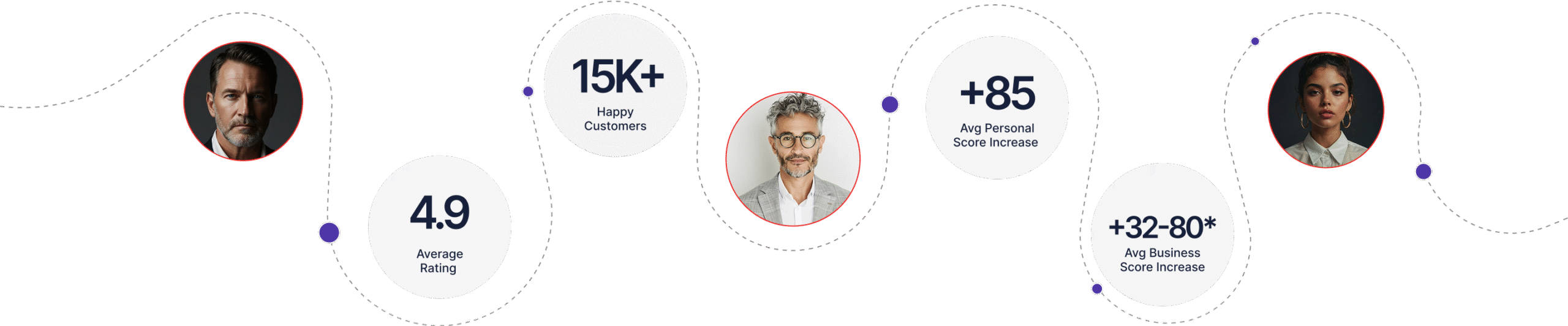

Real Success Stories

See how thousands of customers have transformed their financial lives with HL Hunt Credit Builder

Ready to Join Thousands of Success Stories?

Start building your credit today with 0% APR forever and see results in as little as 30 days